The Future of Insurance: Unveiling the Most Prominent Digital Transformation Trends for 2023

As consumers shift their spending to explore new technological advances, the insurance sector is feeling the heat. Meanwhile, InsurTech startups are affording customers a more straightforward process of finding and buying insurance products online. To remain lucrative in this climate, insurers must anticipate change and wholeheartedly embrace it.

As digital technology becomes the new standard, what is in store for insurance leaders? Here in Part One, we will discuss 8 of 16 digital evolution trends that are set to shape the future of the insurance industry over the next several years.

Enterprise IT is undergoing a dynamic transformation.

Gone are the days when insurance companies viewed IT as merely a means of reducing expenses. Now, enterprise IT has become an essential component for businesses to gain a competitive edge and build customer loyalty. Technology is no longer regarded as just another overhead cost center – it is now seen as the strategic tool that drives growth and enhances customer experience.

1. The ascendance of low or no-code development

Low-code/no-code evolution is becoming increasingly popular in enterprises, even more so than it already has within the Small and Midsize Business segment. Most companies continue to depend on conventional development endeavors run by their internal staff or external contractors – yet this trend of no-code tools is beginning to change that.

Fortunately, vendors are now supplying mature and reliable no-code devices designed to prioritize security and compliance. This allows enterprises to outsource many of the software development responsibilities to line-of-business personnel while remaining in control.

As no-code tools become increasingly mainstream, it is not hard to comprehend why. These technologies are the perfect solution for IT teams overwhelmed with tasks and dealing with extensive backlogs. In addition to providing much-needed relief, they also aid in boosting productivity levels and pushing the team’s efforts even further.

No-code instruments are invaluable for their ability to quickly build and deliver cutting-edge digital solutions, products, and services at a far speedier rate than Conventional development projects. With no-code solutions, insurers now have the ability to revolutionize customer experience by providing better apps in record timing while simultaneously improving the overall quality of their service offerings.

2. The API economy’s growth

As companies increasingly want to share their data and functionality with outside developers, they are turning more and more to Application Programming Interfaces (APIs) – A set of regulations that dictate how two pieces of software communicate. There has been an undeniable surge in APIs over the past few years as organizations recognize their power.

The insurance sector is harnessing the power of APIs to generate breakthrough electronic goods and services. Insurers are already utilizing these technologies for a plethora of reasons, such as giving customers instant access to the most up-to-date quotes and market data with real-time updates or powering virtual assistants and other online customer engagement devices. With this newfound capacity, insurers can give their clients an unprecedented level of convenience and satisfaction.

LenderDock utilizes an API for real-time updates and information verification in its suite of SaaS products. For example, the LenderDock lienholder API makes it easy for carriers to manage lienholder and mortgagee data. It helps to avoid duplicates and incomplete information in internal systems by providing access to the industry’s largest database of accurate lienholder data. LenderDock offers the first-ever solution that automatically manages lienholder data. Their API, which can be accessed in real-time, helps verify lienholder policies, fix mortgagee information, and send digital notifications for billing and payments. This improves the efficiency of key mortgagee transactions.

The need for speed and flexibility, together with the wish to capture new profits are pushing this trend. Many insurers in the insurance sector have launched APIs to give third-party developers permission to construct applications and add services to their main systems. This grants them access to fresh income sources they wouldn’t have been able to obtain otherwise, while drastically reducing time-to-market.

As the demand for digital insurance solutions continues to surge, we anticipate more insurers beginning to take advantage of APIs. This will enable them to maximize this burgeoning market.

3. The increase of “headless technology”

Despite its slightly off-putting name, “headless tech”, or headless architecture, has been around for a while and is completely harmless.

Headless technology is a popular term in website building, where it has become the norm. Unlike traditional websites with back-end and front-end components along with graphical user interfaces; headless technologies have no such features.

The headless technology trend is closely linked to no-code options that are used for the development of interfaces that customers interact with. Insurance providers can now detach their visible user interface layer and subsurface data functionalities, enabling them to create unique digital interactions.

Within the insurance industry, this has become particularly critical as back-end systems are often hindered by outdated technology issues that render them incompatible with customers’ expectations of cutting-edge, user-friendly experiences.

In the coming months, we anticipate that a greater amount of insurance products and applications will employ the trend of compartmentalizing the enhancement of customer experience with both front-end and back-end operations while still allowing for seamless data exchange between them. This strategy is already becoming increasingly popular among businesses as it creates an effective workflow structure.

4. The ever-rising hybrid cloud architecture

Mordor Intelligence estimates that the hybrid cloud market will reach a staggering USD 128.01 billion in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 18.73% from 2020-2025. This extraordinary growth indicates just how invaluable this cutting-edge technology is for businesses today and provides insight into its future potential for success.

Organizations are increasingly turning to the hybrid cloud model in order to take full advantage of both public and private clouds. Hybrid cloud architectures provide the ultimate combination of reliability and scalability.

By leveraging both public and private clouds, businesses can benefit from cost savings while also gaining access to the latest technologies and services required for success in today’s digital world. With hybrid cloud computing, companies are able to discover more efficient ways to store data that offer superior security measures as well as streamlined processes across organizations.

5. The customer data surge

With the continual development of digital channels, there is an immense surge in customer data production. This offers both a daunting test and an advantageous opportunity to insurers alike.

On one side of the equation, insurers must find efficient solutions to amass and keep track of their ballooning data sets. Conversely, those with the ability to use this mountain of information most effectively can harness the ability to attain a definitive upper hand in their industry.

As the years progress, Insurers are expected to make use of complex data analytics tools more and more, in order to gain customer-centric insights from existing datasets. By leveraging these insights, organizations can make substantial improvements to their consumer experience, underwriting procedures, and claims-handling operations. This will ultimately lead to enhanced product offerings or services that are better suited for the target market.

By incorporating the innovative technologies of no-code options and “headless technology,” financial service organizations are able to maintain their existing infrastructures, while simultaneously providing customers and employees with an enhanced digital experience.

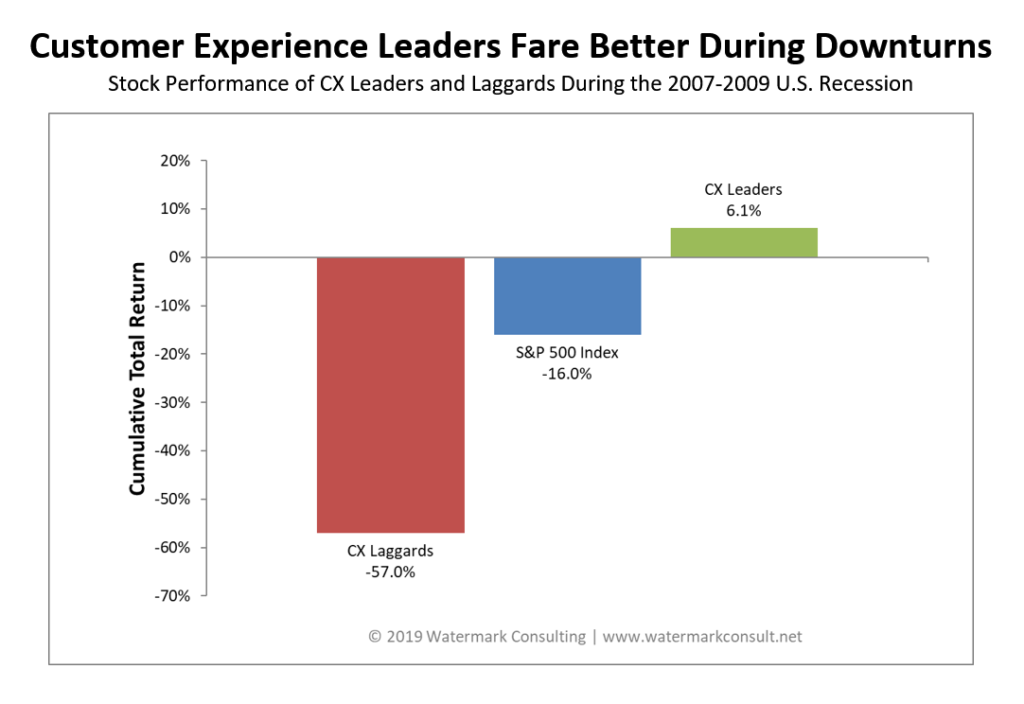

The customer experience is unrivaled, taking precedence over all else.

With the advent of cutting-edge digital technology, customers have been armed with more authority than ever in the insurance industry, an arena that has always prioritized its customers.

Customers now have the luxury of effortlessly uncovering the most attractive deals, comparing various products, and with only a few clicks can easily choose the insurer that best fits their individual requirements.

To achieve this, insurance companies are prioritizing the customer experience. They are customizing goods and services to cater to individual needs more effectively while also improving accessibility through digital mediums.

6. Delivering customized digital products

Leveraging technological breakthroughs such as data analytics and machine learning, companies can now customize products to each individual customer’s specific needs – an idea that is not revolutionary but made feasible only by modern-day technology.

Not long ago, insurers would rely solely on customer surveys and other forms of market research to gather the necessary data. However, with an abundance of information that can now be acquired from sources such as social media, web search history, and even fitness trackers – insurance companies are able to access a much more comprehensive range of facts than ever before.

Benefiting from an abundance of data, insurers are now able to gain an even more comprehensive comprehension of their clients and can offer products that cater specifically to what they need.

7. The revolution of customer-driven service

As the insurance industry continues to evolve, customers increasingly expect more self-service options. Thanks to digital doorways and mobile applications that are now readily available, customers no longer need to talk directly with customer service representatives for even simple tasks.

To keep up with the ever-changing landscape, Insurers are making investments in digital self-service solutions such as online quoting platforms and automated chatbots to enhance the customer experience. This grants customers easier access to information without the need to face long wait times or complicated procedures.

Furthermore, customers are providing insurers with an abundance of extra time by taking on basic tasks themselves. This allows the insurer to prioritize more complex matters with greater efficiency and ease.

As customers’ demand for digital self-service continues to soar, insurance brokers and agents are making a move to the digital world. In April 2020, a survey of European insurance executives revealed that nearly 9 out of 10 respondents anticipate an enormous growth in digitization. Additionally, most expect a dramatic change in their customer channel mixes as well.

8. The growth of online services

Generally, insurance has been distributed through physical channels such as brokers, agents, resellers, offices, or call centers. Currently, the digital option is prevailing in the world of customer transactions. Consumers are now more comfortable with utilizing virtual processes for their dealings and insurance companies have risen to meet this requirement by expanding customer channels digitally.

Customers can access what they need quickly from any device of their choosing with options such as traditional web and mobile self-service outlets, chatbot technology, virtual customer assistants, and even voice-based aid services! This broad selection of user experiences allows customers to engage how they want in order to receive the best possible service.

Technology has revolutionized the way we think about traditionally offline processes. Gone are the days when tedious actions, such as collecting physical signatures or completing medical underwriting, required an in-person presence. Today, advanced technology enables these processes to be completed digitally with legally binding eSignatures and face recognition programs alongside telemedicine services.