Solving the data access dilemma.

Direct from the provider, policy data for verifications, corrections, payments, and more. It just makes sense.

Solving the data access dilemma.

Direct from the provider, policy data for verifications, corrections, payments, and more. It just makes sense.

Integration.

Security.

Lendendock is cloud-based and we’ve deployed state-of-the-art security along with it. Every user is verified. The platform is built to NEVER store policyholder data. It provides fantastic insight into who is doing what and complete audit trails for verifiers and carriers, alike.

Take a look at what we can do…

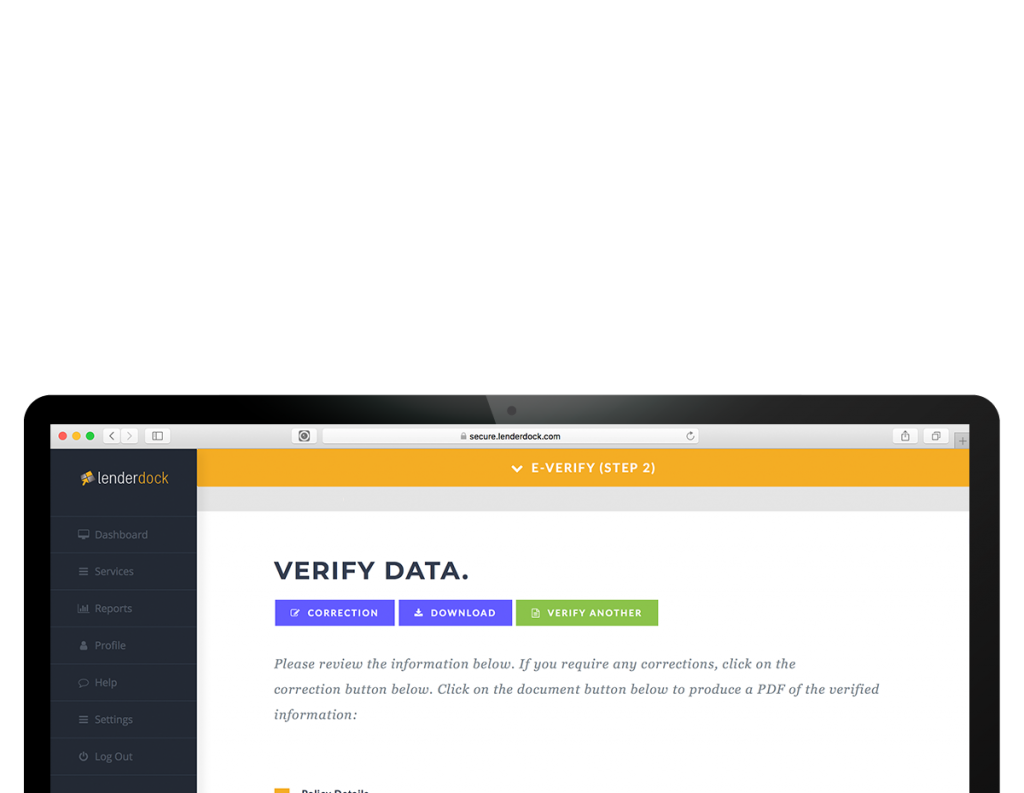

POLICY VERIFY & CORRECT

LenderDock verify and correction service is a “real-time” insurance policy verification system written exclusively for verifiers and lenders to review and update incorrect policy holder and lienholder information.

DOCUMENTS

Electronic delivery of important insurance documents in real-time. Produce EOIs, certificates and other important policy documents to financial 3rd parties, automatically. ACORD standard forms or custom carrier forms.

PAYMENTS

Escrow payment due? Submit escrow payments for any number of policies ELECTRONICALLY, via LenderDock’s secure payment portal.

VOLUME SERVICING

Bulk update or corrections of lien holder information on numerous policies at once. Upload a file to Lenderdock, verify bulk policy data, and submit lien holder updates in just a few clicks of the mouse.

REPORTS & FILES (266 - 811)

EDI doesn’t cover it all so we created a mechanism to read reports and help carriers reconcile to their live policy management system, saving them countless hours of manual review.

We answered the call.

We heard the cry from insurance providers of the time-consuming processes plaguing their call centers and agencies. Little did we know, financial 3rd parties were experiencing the same dilemma. Lenderdock was built with you in mind.

Although we don’t store the data, we still wanted to provide encrypted communications using today’s latest technology.

Speed and uptime is a must for our platform to survive. Cacheing and DoS Attach protection.

Lenderdock utilizes top technology in cloud keeping our platform up and safe.

Contact Us

Our clients range from small to large insurance carriers and our user base extends beyond the insurance industry, touching all financial institutions and other 3rd parties.

Main Contact

- 1-302-202-0755

- [email protected]

- DE

- 1-801-555-5252

- [email protected]

- UT